Beat Declining Purchasing Power with Digital Assets as a Store of Value

This is the 3rd blog in our series on Diversifying Your Portfolio with Blockchain Assets: A Guide for Investors.

Through our examination of cryptocurrencies, and more specifically BTC as an asset class, one of the most prominent advantages to the top performers is the store of value against many other traditional assets.

Diversifying Your Portfolio with Blockchain Assets: Is the Return Worth the Risk?

This is the 2nd blog in our series Diversifying Your Portfolio with Blockchain Assets: A Guide for Investors.

Traditional asset classes have often followed a familiar pattern: an increase in risk often equates to an increase in return, particularly over long investment periods. In the last 10 Years, Bitcoin obtained a 80.03% compound annual return, with a 172.70% standard deviation.

Diversifying Your Portfolio: Is There Room for Crypto in Your Wealth Management Plan?

This is the 1st blog in our series on Diversifying Your Portfolio with Blockchain Assets: A Guide for Investors.

Blockchain developments are now commonplace news headlines. Couple the constant news with the amount of digital investments that are accessible via a myriad of crypto on-ramps, and we have a legitimized young asset class worth investigating.

The Lifeblood of DeFi: Commodity-backed Stablecoins

This is the 3rd blog in our 4-part series covering the basics of stablecoins. This article introduces commodity-backed stablecoins by briefly looking at a couple of specific examples. The first wave of commodity-backed stablecoins are digital representations of traditional commodities that live on blockchains.

Content Ownership in a Web 3.0 World: Embracing Decentralization and Digital Assets

In a world where content is king, the concept of ownership has become increasingly complex. With the advent of Web 3.0, the decentralized web, ownership and control over digital assets has shifted from centralized intermediaries to individual users. This blog post explores how content ownership is being revolutionized in the Web 3.0 era, and the implications of this shift for creators, users, and the internet as a whole.

Do Blockchains Need AI? Exploring the Synergy Between Blockchain Technology and Artificial Intelligence

AI and blockchain technology have the potential to complement each other to enhance the development of emerging technologies. Both AI and blockchain technology leverage computational data, allowing machines to recreate the capabilities of the human mind in a predictive manner. Coupling AI capabilities with blockchain data can supercharge consumer interaction.

It’s 10 pm, Do You Know Where Your Bank Deposits Are?

This blog highlights the key differences between the existing banking system and the self-custody options available in the crypto world. The fractional reserve system of banking means that customers no longer have immediate access to their funds and must trust the bank to ensure the safety of their deposits. In contrast, depositing crypto funds in a self-custody wallet offers immediate access, speed, and segregation of funds that are only available to the owner of the wallet.

Ethereum Shanghai Upgrade: Unlocking Staked Ether and Key Improvements

Learn about the highly anticipated Ethereum Shanghai upgrade, which introduces the ability to withdraw staked ether tokens, and also includes several other Ethereum improvement proposals. Discover how this upgrade could impact staking levels and Ethereum's staking APR. Plus, get a glimpse into what's next on the Ethereum roadmap, including the upcoming Cancun upgrade and the concept of shards.

Understanding the Experience Layer of the Metaverse

Part 8 of 8 - The experience layer of the Metaverse refers to the virtual environment where users interact with each other and digital objects. This layer encompasses the sensory and perceptual aspects of the Metaverse, such as visual and auditory elements, physics, and user interactions.

Understanding the Discovery Layer in the Metaverse

Part 7 of 8. The discovery layer in the Metaverse refers to the system or platform that allows users to navigate and discover the various virtual worlds and experiences that constitute the Metaverse.

5 Crypto Predictions for 2023

Blockchain’s potential to transform the traditional finance world is stronger than ever. New business models and technology tools have revealed the need for asset and transaction transparency, as well as increased trust for central exchanges.

The Metaverse Creator Economy: Opportunities and Challenges

Part 6 of 8. The creator economy layer has the potential to create new business models and revenue streams for creators, developers, and entrepreneurs. Virtual goods and services can be sold in the Metaverse, such as virtual real estate, clothing, and experiences. This creates opportunities to monetize and build new businesses.

Understanding the Spatial Computing Layer of the Metaverse

Part 5 of 8 - The Metaverse has been around for many years, but only recently has begun to attract builders, developers, and designers with advancements in technology. Spatial computing utilizes virtual and augmented reality, disrupts traditional industries, and changes the way we interact with technology on a daily basis. It powers wearables and simulations, blurring the boundaries of real and simulated life.

How Smart Contracts Can Protect Your Investments

When using smart contracts to invest, the benefits of blockchain technology are passed through to the investor. This provides investors unrestricted access to view and audit their investments in real time.

Understanding the Decentralization Layer of the Metaverse

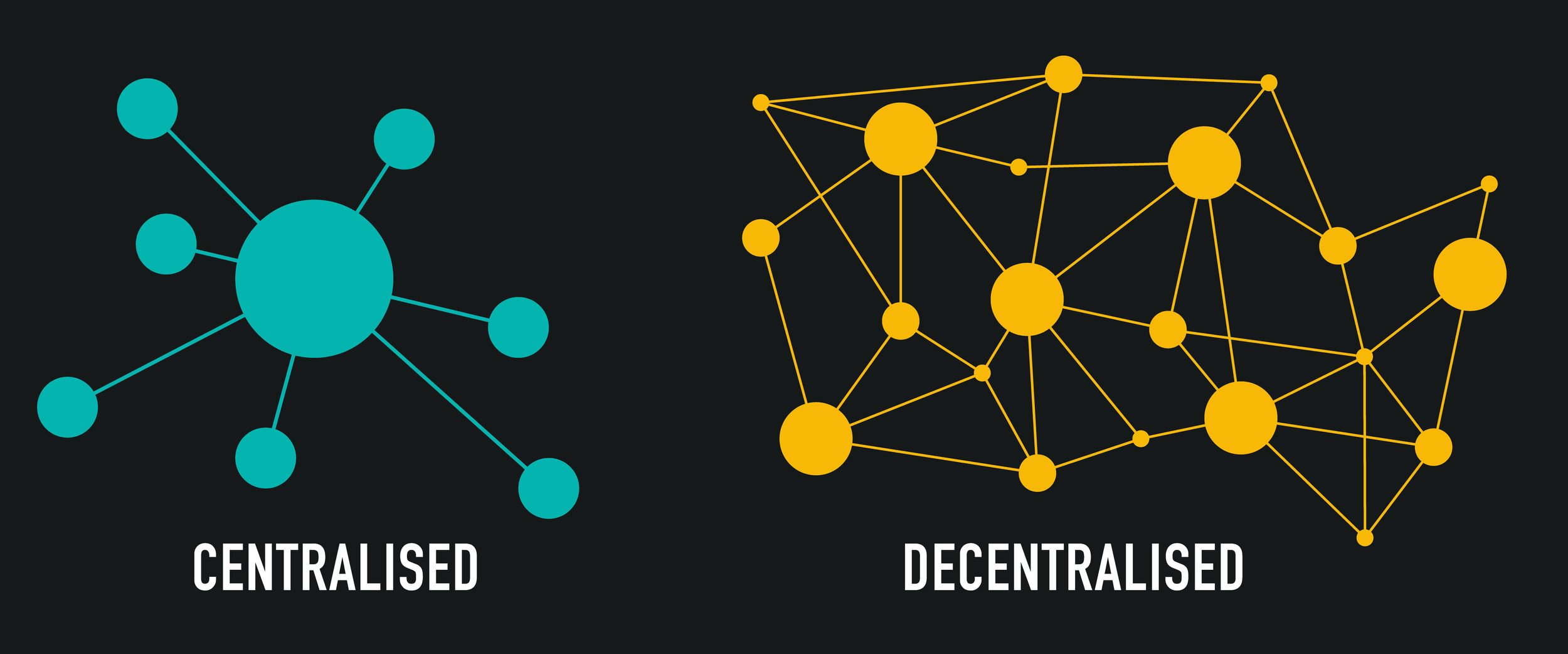

Part 4 of 8. The decentralization layer is made up of blockchain technology, smart contracts, open-source platforms, and the potential for self-sovereign digital identities. A fundamental property of decentralization is that it allows for permissionless participation.

Why On-Chain Matters: Blockchain Investment Strategies for Transparency & Security

Part 4 of 4. As previously detailed, blockchain-native investment strategies provide great benefits to investors and fund managers. Today this primarily applies to crypto assets, but as more non-digital assets become tokenized, they will also become available on-chain.

On-Chain Custody of Digital Assets: Comparing Blockchain and Traditional Finance Custody Solutions

Part 3 of 4. In terms of safeguarding one’s financial assets, blockchain technology supports custody and transparency options that differentiate it from the traditional financial system.

Decentralized Exchange (DEX) vs. Centralized Exchange (CEX)

“The struggle between centralization and decentralization is at the core of financial history.” Unknown

The Lifeblood of DeFi: Fiat-backed Stablecoins

This is the 2nd blog in our 4-part series covering the basics of stablecoins. The mix of assets in a stablecoin’s reserve will define a reserve’s liquidity schedule, speak to the risk tolerance of the governing body, and help investors evaluate a stablecoin’s overall risk of insolvency. This article covers the basics of fiat-backed stablecoins and takes a closer look at the reserve assets of a few popular fiat-backed stablecoins.

Strategies for Building a Diverse Crypto Portfolio

"An investment in knowledge pays the best interest." — Benjamin Franklin