Are the Institutions Coming?

The question is are regulation and security concerns clear enough in a see-saw political landscape for the institutions to dive in?

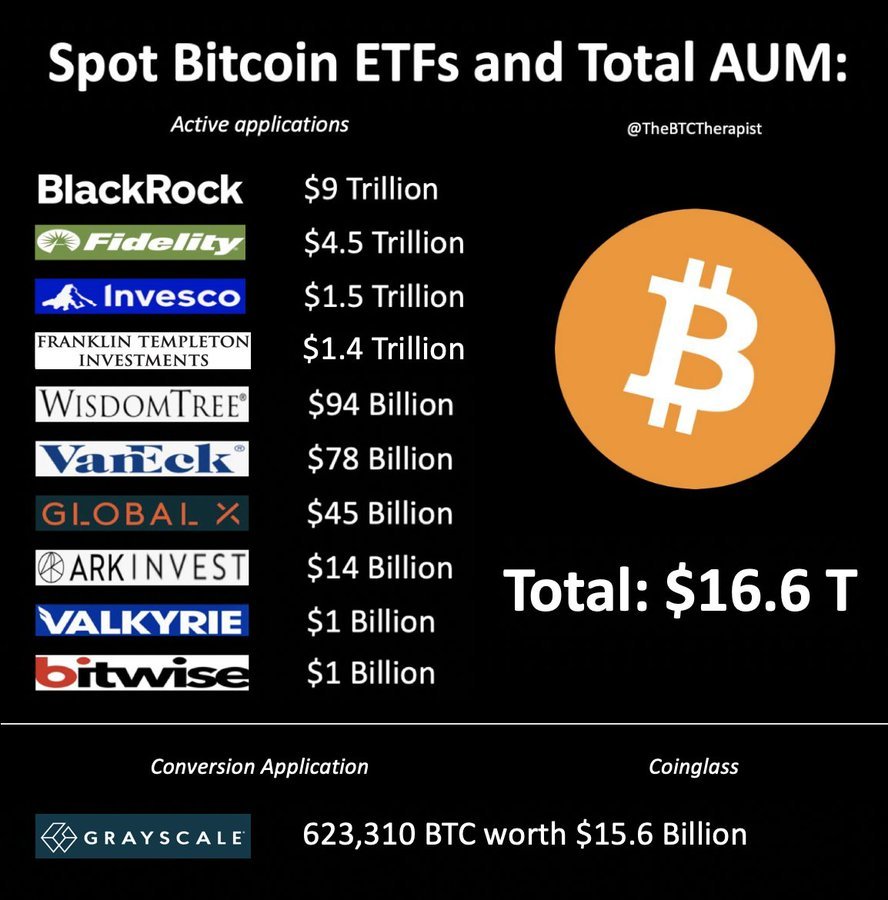

In the ever-changing landscape of finance, the introduction of blockchain technology and digital assets has evoked both skepticism and excitement. However, with financial corporate stalwarts like Blackrock, Fidelity, and Franklin Templeton, among others, taking significant strides into the blockchain space, the latter half of 2024 and beyond is poised to surpass many expectations in terms of assets under management (AUM) in the digital assets realm.

The turning point came with the arrival of the first Bitcoin ETFs in the U.S. in January, marking a pivotal moment in the convergence of traditional and digital assets. As of the latest data, spot BTC ETF inflows have surged, accumulating over $64 billion. Additionally, on the Eve of spot ETH ETF trading, inflows from institutions will only grow. Keep in mind the main ETF applicants hold a combined 16 trillion in AUM. We are just getting started!

Yet, this is merely the beginning of what promises to be a transformative journey. The resurgence of crypto prices, with Bitcoin surging past $60,000 since late February and the frenzy of speculation around meme coins reminiscent of the early days of 2022, has caught the attention of investors worldwide. Despite this, many remain cautious and hesitant to dub the current state a full-blown bull market, perhaps due to past volatility or the lingering lack of widespread public awareness.

However, it's evident that institutional investors are driving the recent rally, fueled by the approval of Bitcoin ETFs and the increasing involvement of traditional financial firms in the digital asset space. This institutional influx has jump started a cycle where institutional capital leads the way, propelling prices higher and attracting further attention from retail traders. Keep in mind that many of the institutions that have invested in BTC, were hard skeptics only a couple years ago. Both IBIT and Fidelity’s FBTC have broken records by becoming the fastest ETFs to hit $10 billion in AUM — reaching this milestone in just 49 and 77 days, respectively, a dramatic shift from the previous record of 647 days.

The integration of blockchain technology and digital assets into capital markets is not a fleeting trend but a profound shift toward enhanced efficiency and innovation. Recent milestones, such as Binance's $4.3 billion settlement with U.S. regulators and the subsequent emergence of innovative custody solutions, serve as powerful illustrations of this transformative journey.

One notable collaboration between Binance and Sygnum introduces a tri-party agreement for off-exchange custody, reducing exchange risk and enhancing accessibility and security for institutional investors. This move signals a broader trend toward institutional adoption and underscores the maturation of the digital asset market.

Despite the longstanding interest in Bitcoin and cryptocurrencies, institutional adoption remains relatively low compared to traditional asset classes. However, the recent introduction of 11 Bitcoin exchange-traded funds (ETFs) and counting, the spot eth ETF approval (with likely more cryptocurrencies to come) could be a game-changer, providing institutional investors with direct exposure to this asset class without the technical complexities associated with ownership. Beyond institutions seeking exposure to BTC through ETF’s, they most likely will seek additional tokens outside of BTC which alternative platforms such as OCI can help achieve this.

Analogous to the introduction of gold ETFs, which offered investors a direct stake in physical gold without the need for possession or security concerns, Bitcoin ETFs present a convenient and secure investment avenue. This accessibility could drive more institutional investors towards Bitcoin, further fueling its price appreciation and solidifying its role as a viable asset class. At current writing we are hearing news of Wells Fargo, JP Morgan and the Bank of Montreal holding spot BTC ETF positions in their SEC filings, just to name a few. We are still early in the movement, but it has begun and you most likely do not want to be late.

While ETF’s allow a gateway of exposure to cryptocurrency, they are certainly not the end all be all for investment options. Ideally, investments in the blockchain space allow investors more direct ownership as well as a variety of investment options. Certainly BTC, and ETH are king in the space, but just like traditional stock portfolios we believe in a similar approach to cryptocurrency investing. The pace at which the blockchain investing environment moves is staggering and is offering many opportunities for investors.

In conclusion, the involvement of financial corporate giants in the blockchain space signifies a seismic shift in the economic landscape. With institutional capital driving the digital asset market forward and innovative solutions addressing regulatory and security concerns, the future of blockchain-based finance appears brighter than ever. As we move into the latter half of 2024 and beyond, the stage is set for unprecedented growth and evolution in the realm of digital assets and blockchain technology. Keep in mind we are early